tax lawyer vs cpa reddit

You dont have that legal shield with a CPA. Thats a long 5 years filled with busy seasons and lots of.

I Had To Do It Accounting Humor Accounting Taxes Humor

If you are dealing with a tax matter going to a CPA may seem obvious but in some cases a tax attorney is better suited for your needs.

. Thats why so many Americans hire a tax professional to guide them. You may work in the accounting field without a CPA license which is different from the legal profession which requires a legal license for most areas of practice. The most important distinction is between legal tax issues and non-legal tax procedures.

Primarily for accountants and aspiring accountants to learn about and discuss their career choice. Honestly they are very very similar at the higher levels. Tax return preparation is a time consuming process - especially when tax situation is complex and may require multiple drafts to achieve the optimal result.

You dont need cpa for Consulting. Get B4 experience in consultingtax and when you want aim for regional law firms not big law but not tiny practices. You will pretty much be considered for tax or regulatory compliance groups and only if you had some experience in those areas.

So I looked into doing international tax state and local tax etc. Tax Attorney Vs. This makes the planning process easier for my clients who know that I have all their bases covered.

Choose a tax lawyer when receiving notices of debt. By being both a CPA and lawyer my ability to understand the numbers as well as the legalities associated with estate planning help me bridge that gap and avoid conflict. You can share such secrets with your tax attorney and rest assured the information will be kept.

Take the full ride tier 2 isnt a bad place to be. After working at different accounting firms I found that I liked working with high net worth individuals because my research and writing abilities. Learn the differences between a tax attorney and CPA.

One of my interviewers for a investment firm graduated as an accounting major at my school did audit 2 years went to law school and landed a job at his current gig as a tax attorney. Secondly while attorneys may have taken courses on tax or estate law this. Whats the Difference Between a Tax Attorney a CPA and an Enrolled Agent With all of the rules and codes governing income tax filing its easy to get overwhelmed.

While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes the advantages of having a two-in-one professional are hard to overstate. As an accountant you may prepare taxes and do bookkeeping although a CPA license allows you to represent a tax client before the IRS and sign off on audits carrying higher prestige and salaries. While both CPAs and tax attorneys can represent your best interests in communications with the IRS a tax attorney is generally the better choice if youre involved in trouble with tax authorities such as owing thousands in back taxes or facing liens and levies.

Hire a tax attorney if youre one of the unlucky 25 getting audited this year or if youre dealing with any other tax controversies. Each plays a distinct role and theres a good rule of thumb for choosing one. Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often confusing universe of taxes.

Students in tax at the graduate level going for an mtax are often sitting side by side. The ceiling for cpa is much lower and compensation reflects that. Members of both professions work on a variety of tax-related issues and their expertise can overlap in certain areas.

A tax attorney is a lawyer who knows how to review your tax decisions to see what the IRS allows. When You Need A Tax Lawyer vs. As a general rule tax lawyers engage accountants CPA or EA for preparation of tax returns for their clients.

With a tax attorney you enjoy the protection of attorney-client privilege. For example if youre hiding money in an offshore account. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US.

When You Need An Accountant. There is heavier accounting work at the Big 4 even if youre mainly in a transactions or advisory capacity and heavier strictly legal work at law firms as youd expect - ie you might be called to review a compliance project at the Big 4 and draft ie the tax risk clauses in a. If you want to know whether you can or cant do regarding taxes what the IRS will allow.

Hes kind of living the life right now. Tax is more relevant to accounting and tax. The nice thing about Tax Law is youll be employable and prestige is overrated.

With all the related interpretations and cases. If you have top 10 law school credential you have better educational credentials than maybe 90 of people in big 4. 833 MWLAWCA 833-695-2922 About Us.

A tax attorney is a type of lawyer who specializes in tax law. After law school and obtaining my CPA license I knew I wanted to begin working in an area of law that had an emphasis on tax. They usually do well but where youre located is also important.

3y Audit Assurance. For example tax attorneys specialized in real estate in places like NYC and Miami are rolling in it. Some lawyers prepare tax returns and many accountants help.

In the tax area the lines between accountants and attorneys can be blurred. Tax lawyers hourly rates are too high to justify that. A CPA-attorney when asked what he does for a living replies that he practices tax.

Unfortunately your law degree will limit your options in accounting firms even if you have a CPA. Understanding these differences will make it easier to decide what you are in need of. Learn the differences between a tax attorney and CPA.

A cpa at the big 4 will start out in the mid-50k range and maybe be at 100k after 5 years in a big metro. Anything you tell your CPA could be divulged to the IRS or in court. Im in tax MA at a big 4 in NYC.

Tax attorneys provide attorney-client privilege. If you need someone to handle the numbers to tell you what you have and what you owe you want a CPA. This is understandable according to James Mahon a shareholder in the Tax and Litigation practice groups of law firm Becker Poliakoff.

Best Tax Practices Tax Preparer vs CPA Attorney Lawyer Using a hammer to pound in a screw SCENARIO 1 What do you do I am a tax preparer Oh are you a CPA SCENARIO 2 Someone who wants to be an actor will frequently think they only and immediately need three 3 things a headshot an agent and membership in an. Advice and questions welcome. Probably about 75 of the group are attorneys with tax LLMs from NYU or Georgetown.

It is title 26 of united states code. Honestly tax lawyer is an entirely different path from a cpa. There are clear distinctions to be made between tax lawyers and accountants.

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

What Not To Diy For Your Wedding Words Quotes Inspirational Quotes

Top Rated Tax Resolution Firm Tax Help Polston Tax

Turbotax Vs Accountant When Should You Hire A Cpa

Pin By Raymond J Busch Ltd Cpa On Accountants Have A Sense Of Humor Too Accounting Humor Taxes Humor Accounting Career

Pin By Kristen Corey On Cat Act Funny Cat Pictures Taxes Humor Funny Cats

Top 10 Cpas In Orlando Florida Peterson Acquisitions

Ian Dinovo Cpa Cga Director Primary Instructor Canadian Tax Academy Linkedin

Puffin115110 Men S Value T Shirt Half Man Half Puffin Light T Shirt Cafepress T Shirt Short Sleeve Tee Shirts Everyday Essentials Products

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

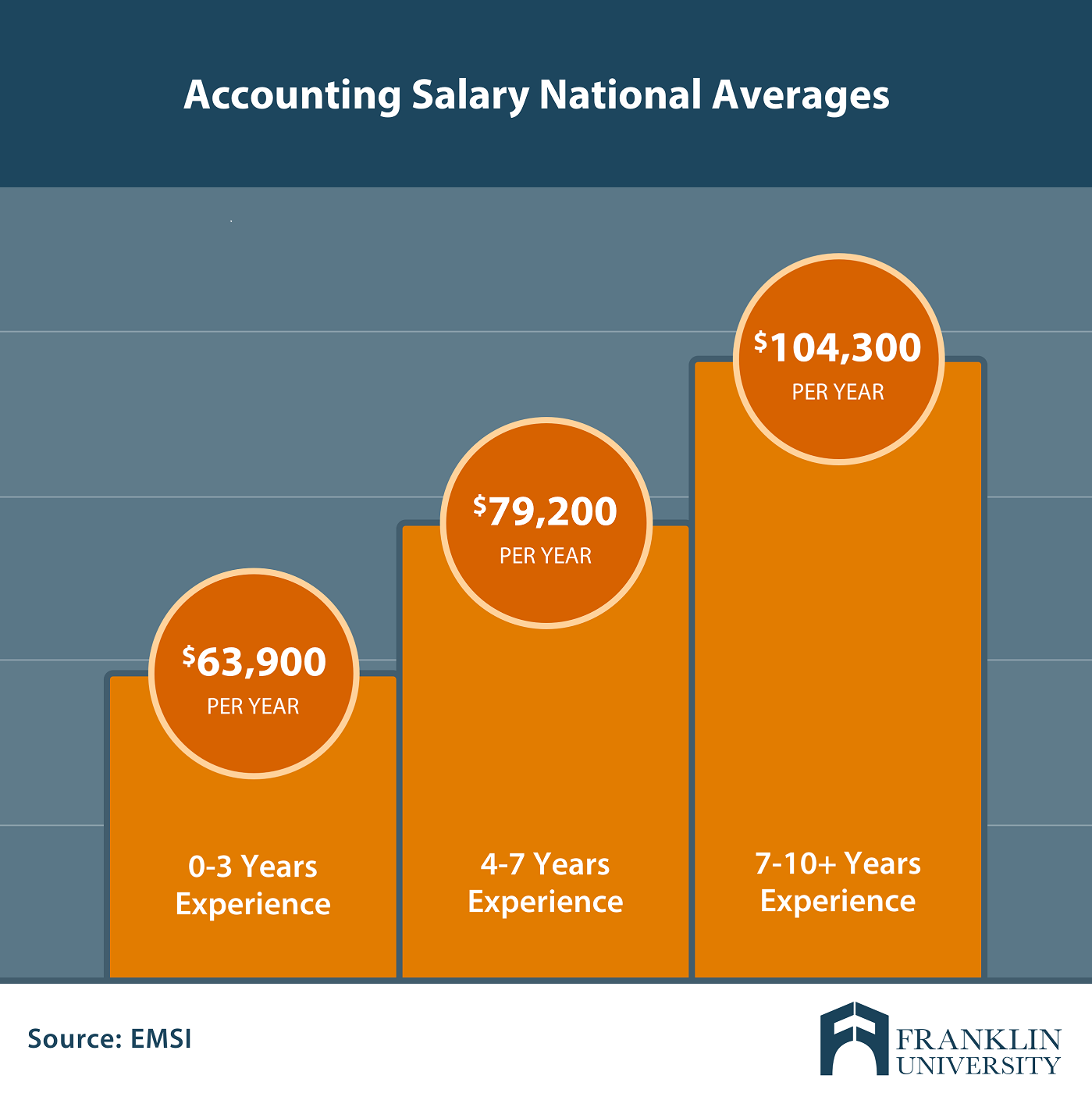

Master S Degree In Accounting Salary What Can You Expect

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

The Cpa In Public Accounting Starter Pack R Starterpacks

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Is A Tax Preparer Liable For Mistakes

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Top Rated Tax Resolution Firm Tax Help Polston Tax